India and Malaysia have agreed to settle trade in the Indian rupees, the Ministry of External Affairs announced

Key Points On India and Malaysia Trade Settlement

- The announcement about India and Malaysia to settle trade in the Indian rupees came in the backdrop of ongoing official efforts to Safeguard Indian trade from the impact of Ukraine crisis.

- The shift away from The U.S. dollar which has been the dominant reserve currency for international trade so far has added significance as it indicates India is willing to take concrete steps towards de-dollarisation of its international trade.

- The Union Bank of India in a statement said that it has become the first bank in India to operationalise this option by opening a Special Rupee Vostro Account through its “corresponding bank” in Malaysia — India International Bank of Malaysia.

Background Of India and Malaysia Trade Settlement

- In July 2022, the Reserve Bank of India (RBI) allowed the settlement of international trade in Indian rupees.

- In December 2022, India saw its first settlement of foreign trade in rupee with Russia – as part of the ‘International Settlement of Trade in Indian Rupee’ mechanism initiated by the RBI.

- In March 2023, banks from 18 countries were allowed by the RBI to open Special Rupee Vostro Accounts (SRVAs) to settle payments in Indian rupees.

- It includes: Botswana, Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Russia, Seychelles, Singapore, Sri Lanka, Tanzania, Uganda, and the United Kingdom.

Significance Of India and Malaysia Trade Settlement

What Is International Trade Settlement In Rupees?

- When countries import and export goods and services, they have to make payments in a foreign currency.

- Since the US Dollar is the world’s reserve currency, most of these transactions are entered into US dollars.

- For example, if an Indian buyer enters into a transaction with a seller from Germany, the Indian buyer has to first convert his rupees into US dollars. The seller will receive those dollars which will then be converted into Euros.

- Here, both the parties involved have to incur the conversion expenses and bear the risk of foreign exchange rate fluctuations.

- This is where trade settlement in rupees comes in – instead of paying and receiving US dollars, the invoice will be made in Indian rupees if the counterparty has a Rupee Vostro account.

Benefits

- India is a net importer and the value of the Indian rupee has been declining consistently.

- Using the rupee for international trade transactions will help check the flow of dollars out of India and slow the depreciation of the currency

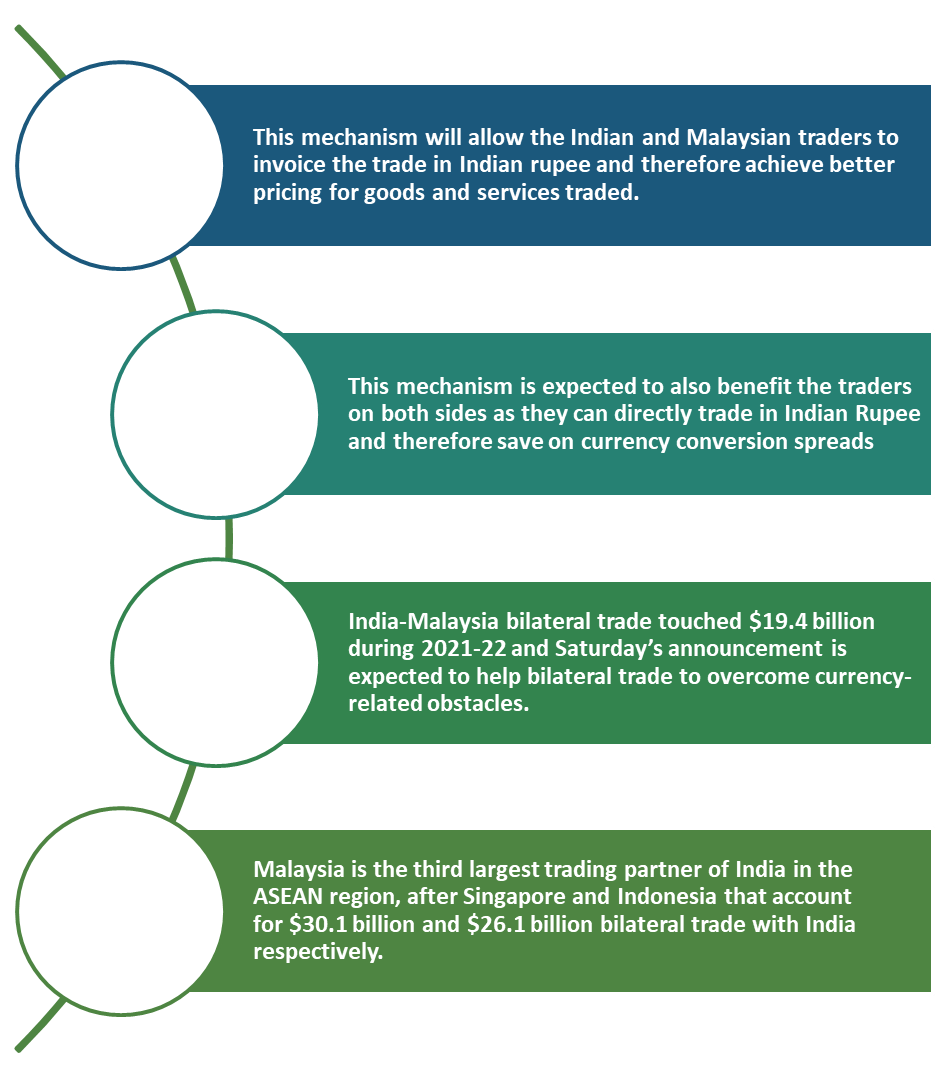

- With the ability to invoice trade in Indian rupees, Indian traders can achieve better pricing for their goods and services.

- Also, this mechanism is expected to benefit both sides of the trade by reducing currency conversion spreads.

- International trade settlements in rupee are expected to gradually contribute to the global acceptance of the currency, and later make it possible to repay loans taken from fund banks like the Asian Infrastructure Investment Bank.

‘Special Rupee Vostro’ Bank Account

- Authorised Indian banks must open and maintain Special Rupee Vostro accounts of the partner trading country’s banks.

- These accounts keep the foreign bank’s holdings in the Indian counterpart, in rupees. When an Indian trader wants to make a payment to a foreign trader in rupees, the amount will be credited to this Vostro account.

- Similarly, in the reverse scenario, the amount to be paid to an Indian trader is deducted from the Vostro account, and credited to the person’s regular account.

To Download Monthly Current Affairs PDF Click here

Get Inspiration from CLAT 2025 Topper

Click here to get a free demo

Everything About CLAT 2025