The Indian rupee ended 2022 as the worst-performing Asian currency with a fall of 10.14%, its biggest annual decline since 2013, as the dollar rocketed on the U.S. Federal Reserve’s aggressive monetary policy stance to tame inflation.

Key Points On Indian Rupee

- The rupee finished the year at 82.72 to the U.S. currency, down from 74.33 at the end of 2021, while the dollar index was headed for its biggest yearly gain since 2015.

- During the year, the Chinese Yuan, Philippine Peso and Indonesian Rupiah fell around 9%. South Korean Won and Malaysian Ringgit declined by nearly 7% and 6%, respectively.

- The rupee was also a victim of a rally in oil prices sparked by the Russia-Ukraine conflict, which pushed India’s current account deficit to a record high in the September quarter in absolute terms.

- However, the Reserve Bank of India (RBI) heavily intervened in the forex market to defend rupee. Since the beginning of 2022, the country’s foreign exchange reserves have fallen by USD 70 billion. It stood at USD 562.81 billion as of 23rd December 2022.

- Reserves have witnessed a bit of erosion but the central bank is now starting to again build up its reserves and that would act as a buffer in times of uncertainty.

What Was The Reason For Capital Outflows?

- The US Fed aggressively raised interest rates by 425 basis point (bps) in 2022 in its fight against inflation.

- This led to a higher interest rate differential between the US and India, and investors pulled out money from the domestic market and started investing in the US market to take advantage of higher rates.

- In 2022, Foreign Portfolio Investors (FPIs) pulled out Rs 1.34 lakh crore from the Indian markets – the highest-ever yearly net outflow.

- They withdrew Rs 1.21 lakh crore from the stock markets and Rs 16,682 crore from the debt market in 2022, putting pressure on the rupee.

- Russian invasion of Ukraine accentuated the FPI withdrawals with the global economic slowdown making inflows tougher

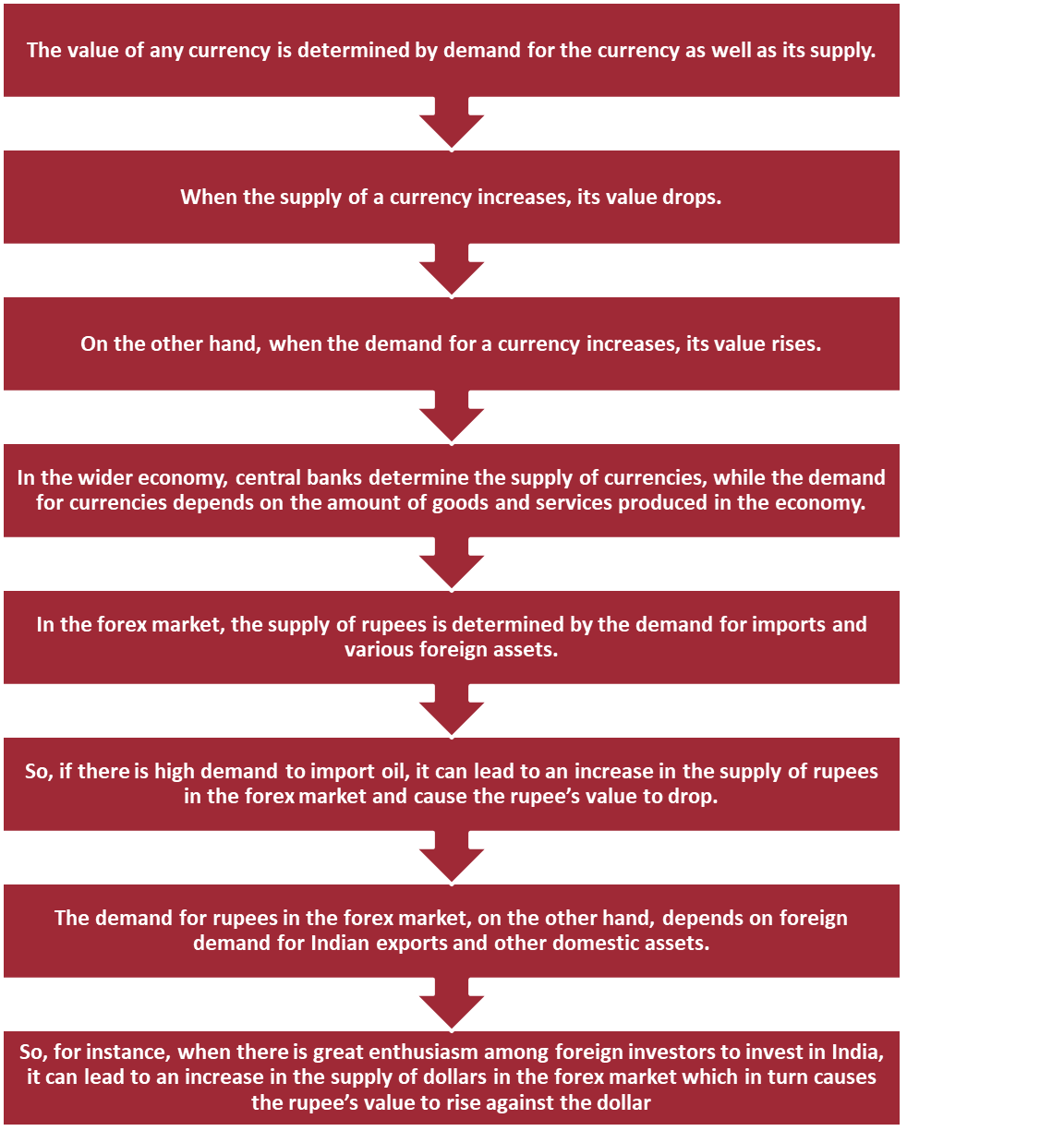

What Determines The Indian Rupee Value?

Depreciation

- Currency depreciation is a fall in the value of a currency in a floating exchange rate system.

- Rupee depreciation means that the rupee has become less valuable with respect to the dollar.

- It means that the rupee is now weaker than what it used to be earlier.

- For example: USD 1 used to equal to Rs. 70, now USD 1 is equal to Rs. 77, implying that the rupee has depreciated relative to the dollar i.e., it takes more rupees to purchase a dollar.

Impact of Depreciation of Indian Rupee

- Depreciation in rupee is a double-edged sword for the Reserve Bank of India.

- Weaker rupee should theoretically give a boost to India’s exports, but in an environment of uncertainty and weak global demand, a fall in the external value of rupee may not translate into higher exports.

- It poses risk of imported inflation and may make it difficult for the central bank to maintain interest rates at a record low for longer.

- India meets more than two-thirds of its domestic oil requirements through imports.

- India is also one of the top importers of edible oils. A weaker currency will further escalate imported edible oil prices and lead to a higher food inflation.

To Download Monthly Current Affairs PDF Click here

Click here to get a free demo

Everything About CLAT 2025