The Prime Minister has lauded Pradhan Mantri Mudra Yojana on the completion of 8 years. The yojana has played a vital role in funding the unfunded and ensuring a life of dignity as well as prosperity for countless Indians

Pradhan Mantri Mudra Yojana

- The Pradhan Mantri MUDRA Yojana (PMMY) was launched on 8thApril 2015 by Prime Minister Shri Narendra Modi

- It was launched to facilitate easy collateral-free micro credit of up to ₹10 lakh to non-corporate, non-farm small and micro entrepreneurs for income generating activities.

- MUDRA, which stands for Micro Units Development & Refinance Agency Ltd., is a financial institution set up by the Government.

- It provides funding to the non-corporate small business sector through various last-mile financial institutions like Banks, Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs).

- MUDRA does not lend directly to micro-entrepreneurs/individuals.

Pillars Of Pradhan Mantri Mudra Yojana

- The implementation of financial inclusion programme in the country is based on three pillars, namely,

- Banking the Unbanked

- Securing the Unsecured and

- Funding the Unfunded

- These aforesaid three objectives are being achieved through leveraging technology and adopting multi-stakeholders’ collaborative approach, while serving the unserved and underserved as well.

- One of the three pillars of FI – Funding the Unfunded, is reflected in the Financial Inclusion ecosystem through PMMY, which is being implemented with the objective to provide access to credit for small entrepreneurs

Features Of Pradhan Mantri Mudra Yojana

- The loans have been divided into three categories based on the need for finance and stage in maturity of the business.

- These are Shishu (loans up to ₹50,000/-), Kishore (loans above ₹50,000/- and up to ₹5 lakh), and Tarun (loans above ₹5 lakh and up to ₹10 lakh).

- Loans under PMMY are provided to meet both term loan and working capital components of financing for income generating activities in manufacturing, trading and service sectors, including activities allied to agriculture such as poultry, dairy, beekeeping, etc.

- The rate of interest is decided by lending institutions in terms of RBI guidelines. In case of working capital facility, interest is charged only on money held overnight by borrower.

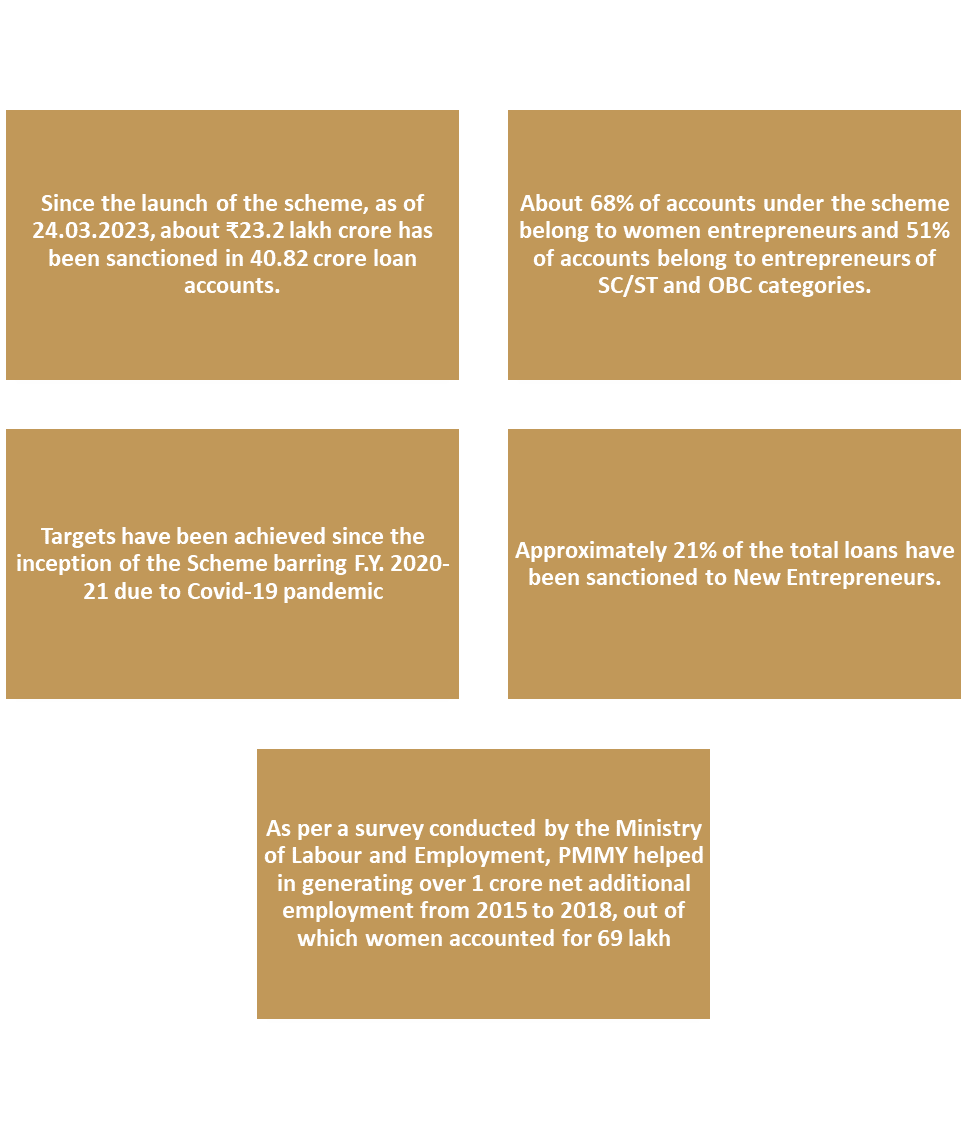

Achievements Of Pradhan Mantri Mudra Yojana

Benefits of Pradhan Mantri Mudra Yojana

- The growth of MSMEs has contributed massively to the “Make in India” programme as strong domestic MSMEs lead to increased indigenous production both for domestic markets as well as for exports.

- The PMMY scheme has helped in the generation of large-scale employment opportunities at the grassroots level

- It has brought the unserved and under-served sections of the society within the framework of institutional credit.

- The government policy of promoting MUDRA has led millions of MSME enterprises in the formal economy and has helped them to get out of the clutches of money-lenders offering very high cost funds.

To Download Monthly Current Affairs PDF Click here

Get Inspiration from CLAT 2025 Topper

Click here to get a free demo

Everything About CLAT 2025