Insurance Regulatory and Development Authority of India (IRDAI) has committed to enable ‘Insurance for All’ by 2047

Key Points On IRDAI Vision 2047

- Insurance for All by 2047 aims that every citizen has an appropriate life, health and property insurance cover and every enterprise is supported by appropriate insurance solutions.

- It also aims to make the Indian insurance sector globally attractive

- It can help people in households all over the country to have access to an affordable insurance policy that covers health, life, property, and accidents.

- These policies would offer faster claim settlements, sometimes within hours, and additional benefits like gym or yoga memberships.

Pillars Of IRDAI Vision 2047

The focus of IRDAI is to strengthen the three pillars of the entire insurance ecosystem

- insurance customers (policyholders),

- insurance providers (insurers) and

- insurance distributers (intermediaries)

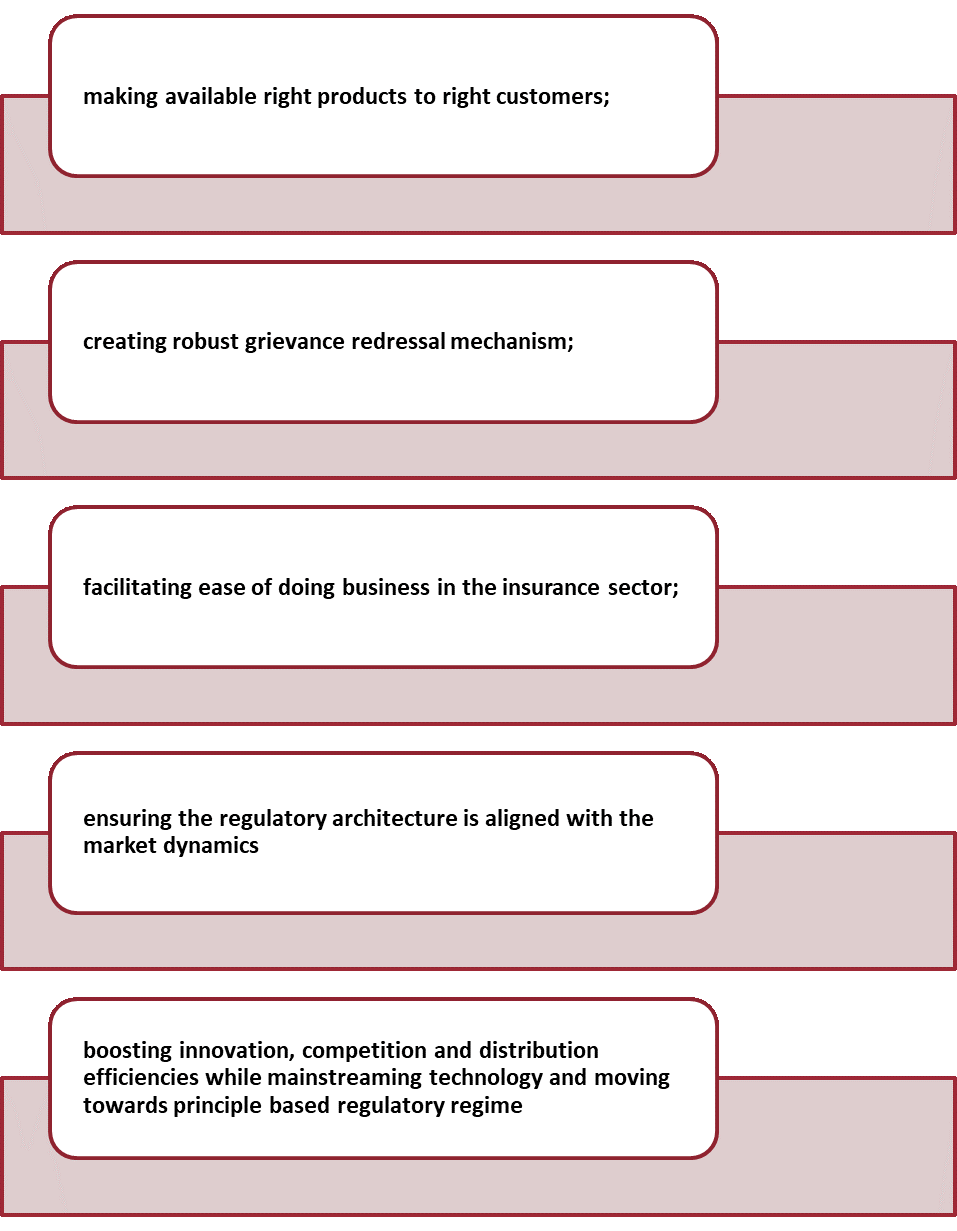

Objectives Of IRDAI Vision 2047

Bima Trinity

It is a program to correct the huge protection gaps that exist even today in almost all the lines of the insurance, be it life, health, motor, property or crops

Bima Sugam

- A new Bima Sugam platform will integrate insurers and distributors on to one platform to make it a one-stop shop for customers, who at a later stage can pursue service requests and settlement of claims through the same portal.

Bima Vistar

- Bima Vistar will be a bundled risk cover for life, health, property and casualties or accidents, with defined benefits for each risk that can be paid out faster than usual without the need for surveyors.

Bima Vaahaks

- The third part of the trinity envisaged by the IRDA entails a women-centric workforce of Bima Vaahaks (carriers) in each Gram Sabha that will meet the women heads of each household to convince them that a composite insurance product like Bima Vistar can “come in handy if there is any distress”.

IRDAI 11-Point Reforms

- Regulations pertaining to registration of Indian insurance companies are eased to promote ease of doing business.

- Tie-up limits for intermediaries have been increased to enable the policyholders to have wider choice and access to insurance.

- Amendments in the Regulatory sandbox to promote innovation and technological solutions in the industry.

- Amendments have been introduced to facilitate ease of raising capital for insurance companies and the limits are enhanced.

- Actuaries play a pivotal role in the operations of an insurer. To ensure sufficient supply of Actuary professionals in the industry, the experience and qualification requirements have been made flexible.

- To increase insurance penetration in Crop Insurance, solvency norms for general insurers have been eased.

- In order to enable efficient utilization of capital, solvency norms have been revised.

- Listing of insurers in the stock exchanges allows the insurers to raise capital. It will also enhance the transparency, efficiencies and accountability of insurers

IRDA

- Insurance Regulatory and Development Authority (IrDA) is an autonomous, apex and statutory body which regulates and develops the insurance industry in India.

- It was established under IrDA act 1999, which was passed on the recommendation of the Malhotra Committee report of 1994.

- IRDA began functioning in April 2000. This agency operates from its headquarters at Hyderabad, where it was shifted from Delhi in 2001

Functions Of IRDA

- Protect the rights of policy holders

- Provide registration certification to life insurance companies

- Renew, Modify, Cancel or Suspend this registration certificate as and when appropriate.

- Promoting efficiency in the conduct of insurance business;

- Promoting and regulating professional organisations connected with the insurance and re-insurance business

- Regulating investment of funds by insurance companies;

- Adjudication of disputes between insurers and intermediaries or insurance intermediaries

To Download Monthly Current Affairs PDF Click here

Get Inspiration from CLAT 2025 Topper

Click here to get a free demo

Everything About CLAT 2025