The Goods and Services Tax (GST) Council has announced Online Gaming Tax which means that bets placed in online gaming, horse racing, and casinos will now levy a 28 per cent tax at full value

Key Points From The GST Council Amendment

- The effective date for the 28 per cent GST levy on online gaming will be announced after amendments to GST law, said Finance Minister Nirmala Sitharaman after the 50th GST Council Meeting.

- Sitharaman said the decision was not aimed at killing the industry but was made considering the “moral question” that it cannot be taxed at par with essential commodities.

- However, online gaming companies said that the government’s move was “extremely unfortunate” as it will lead to “a nearly 1000% increase in taxation.”

- The GST Council’s decision is “unconstitutional, irrational, and egregious” and will wipe out the entire Indian gaming industry and lead to lakhs of job losses.

- The only people benefitting from this will be anti-national illegal offshore platforms.

Details of the 28% Online Gaming Tax

- The uniform levy of 28 per cent tax will be applicable on the face value of the chips purchased in the case of casinos, on the full value of the bets placed with bookmaker/totalisator in the case of horse racing, and on the full value of the bets placed in case of online gaming.

- Earlier, the ministerial panel on online gaming, casinos, horse-racing had discussed the other option of levying tax on gross gaming revenue or platform fee, that is, the charge paid to avail the gaming services, but this did not find favour.

- The government will bring in amendments to the GST-related laws to include online gaming and horse racing in Schedule III as taxable actionable claims.

- In the context of GST, an actionable claim is defined as goods under the Central Goods and Services Tax Act, 2017.

- It is a claim to an unsecured debt or a claim to any beneficial interest in movable property that is not in the possession of the claimant.

- So far, lottery, betting, and gambling were classified as actionable claims. Now, horse racing and online gaming will be added.

Example of GST Impact on Online Gaming Tax

- At present, most gaming companies were paying a tax of 18% applicable on the platform fees.

- Let’s assume that the platform fee is 10%. So, for every Rs 100 deposited in the game, the platform makes Rs 10 and 18% GST on Rs 10 means that effectively, on every Rs 100, the GST is Rs 1.8.

- Under the new structure, a GST of 28% will be applicable on the entire face value of the bet or the consideration paid, and not the platform fee.

- Meaning that for every Rs 100 deposited, the GST on it will be Rs 28 – an increase of around 15.6 times.

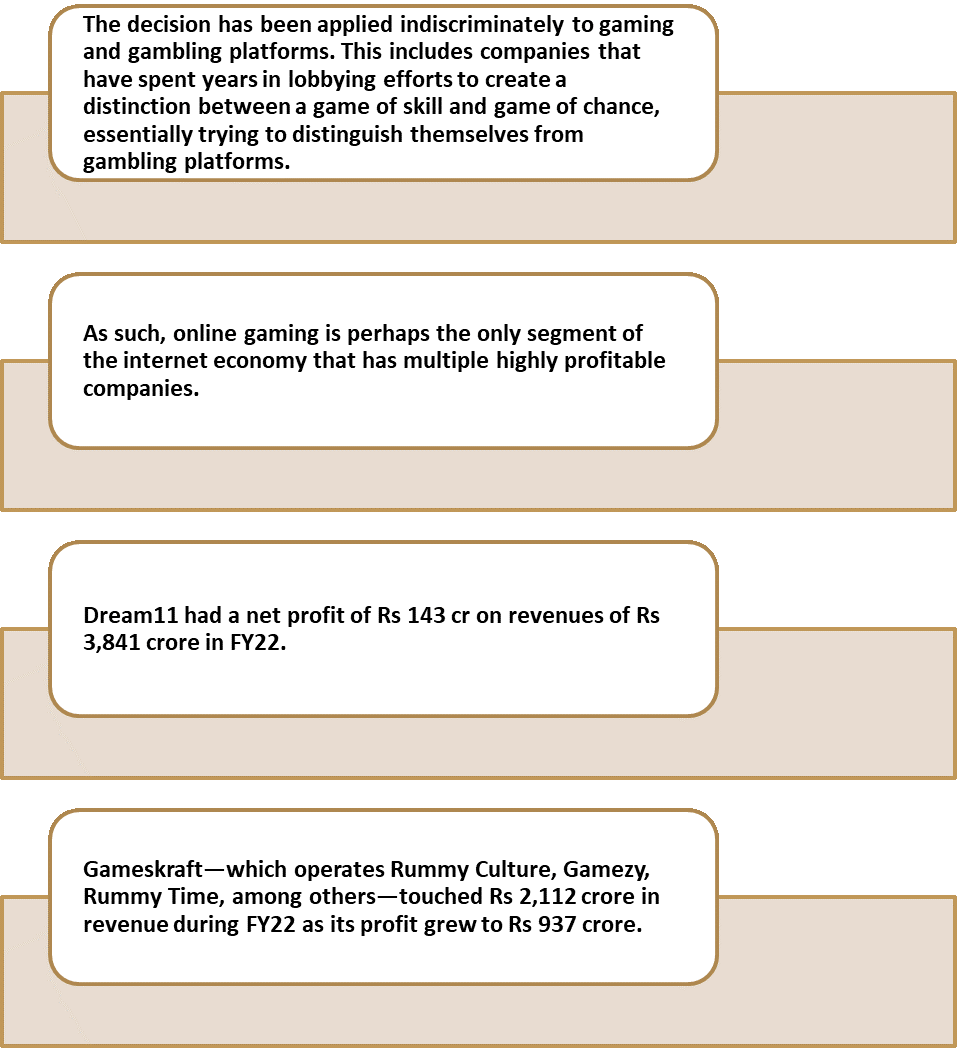

Impact Of the Online Gaming Tax On The Industry

Online Gaming Market In India

- The revenue of the Indian mobile gaming industry is estimated to reach $5 billion in 2025.

- The industry in the country grew at a CAGR of 38% between 2017-2020, as opposed to 8% in China and 10% in the US.

- It is expected to grow at a CAGR of 15% to reach Rs 153 billion in revenue by 2024.

- India’s percentage of new paying users (NPUs) in gaming has been the fastest growing in the world for two consecutive years, at 40% in 2020 and reaching 50% in 2021.

- According to a report by EY and FICCI, transaction-based games’ revenues grew 26% in India, with the number of paying gamers increasing by 17% from 80 million in 2020 to 95 million in 2021

How Online Gaming Tax Works in Other Countries?

United States of America

- In the US, a flat tax is deducted on earnings from e-sports and online gaming but the exact rate depends on which state you are in.

- Online gaming is usually taxed at 10 percent in most states. But 30 percent tax is imposed on any winnings through online gaming and e-sports winning.

United Kingdom

- In the UK a variable tax slab is applied, starting at 15 percent for the first $3.5 million earned on the GGR, and going up to 50 percent for amounts over $17.8 million earned.

- While winnings on gambling are tax-free in the country, tax rates for e-sports are set at 40-45 percent

European Union

- The situation in the EU is slightly more complicated, but the tax rate revenue is set at 15-20 percent while taxation on winning is anywhere between 15-50 percent depending on the amount and the member state.

To Download Monthly Current Affairs PDF Click here

Get Inspiration from CLAT 2025 Topper

Click here to get a free demo

Everything About CLAT 2025

Online Gaming Tax FAQs

What is the new 28% GST on online gaming in India?

The GST Council has imposed a 28% tax on the full value of bets placed in online gaming, horse racing, and casinos in India

How does the 28% GST impact online gaming companies?

The new tax will significantly increase tax liabilities, which some companies fear will hurt profits and push users to illegal platforms

Why did the GST Council apply 28% GST on the full value of bets?

The Council believes online gaming should be taxed higher due to its nature, distinguishing it from essential commodities.

How does the 28% GST compare to global tax rates?

Globally, taxes range from 10% in the US to 50% in the UK, depending on the market and revenue.