The Union Ministry of Finance, through a gazette notification, has brought Virtual Digital Assets (VDA) or the Cryptocurrency under the PMLA (Prevention of Money Laundering Act)

Cryptocurrency Under PMLA

- Cryptocurrency transactions continue to lack transparency and the trail is difficult to establish.

- This moves pushes responsibility on the cryptocurrency markets to bring transparency to cryptocurrency trading.

- Compliance is a must not just to safeguard interest of investors but also of the country

- The measure is also expected to aid investigative agencies in carrying out action against crypto firms.

- VDA service providers / businesses have now become the ‘Reporting Entities’ under the Act, and they have to follow similar reporting standards and KYC norms as the other regulated entities like banks, securities intermediaries, payment system operators, etc.

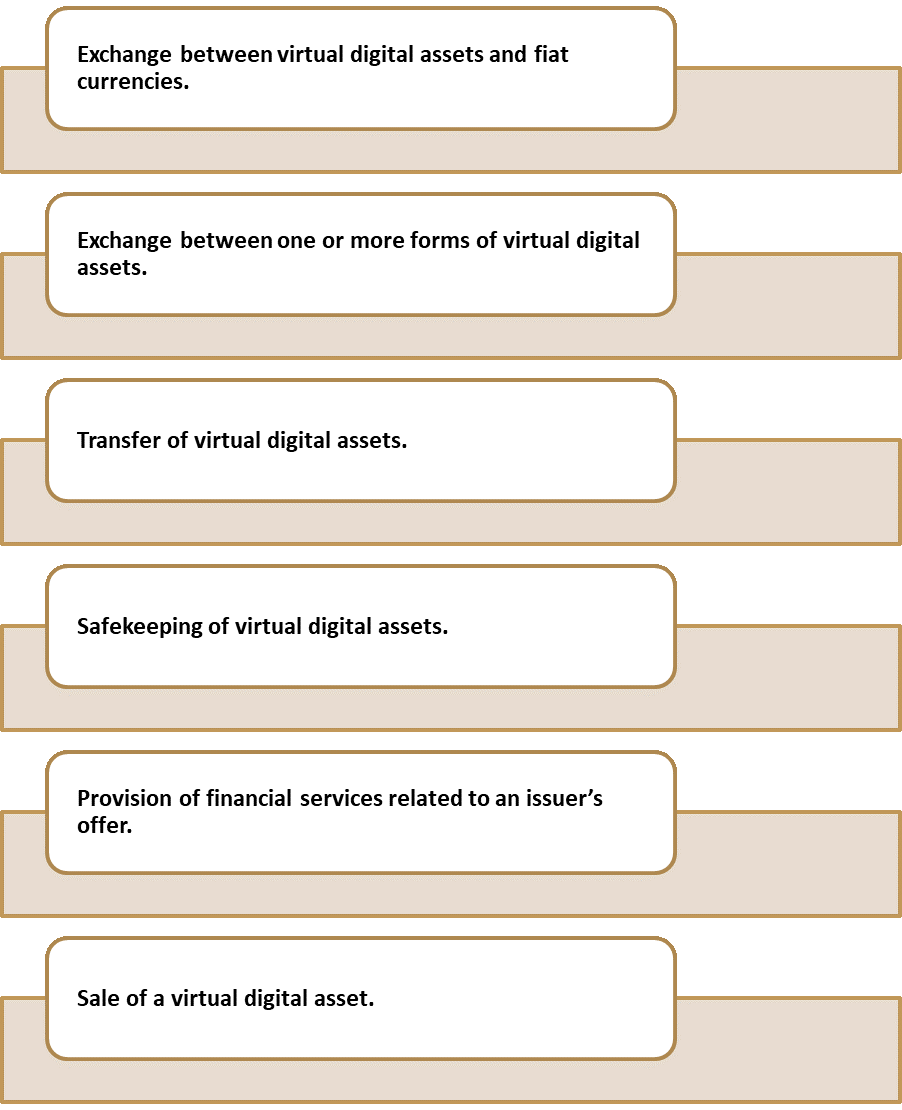

Nature Of Transactions To Be Covered Under PMLA

Legal Status Of Crypto In India

- In the Union Budget 2022-23, even though the government brought in a tax for cryptocurrencies, it did not proceed with framing regulations.

- Earlier, the Reserve Bank (RBI) of India had proposed a ban that was set aside by Supreme Court order.

- In July 2022, flagging the RBI’s concerns, the finance minister told Parliament that “international collaboration” would be needed for any effective regulation or ban on cryptocurrency.

- From April 2022, India introduced a 30% income tax on gains made from cryptocurrencies.

- In July 2022, rules regarding 1% tax deducted at source on cryptocurrency came into effect

PMLA – Prevention Of Money Laundering Act

- It was enacted in January 2003 and the Act along with the Rules framed thereunder has come into force with effect from 1st July 2005.

- 3 of the act defines offence of money laundering as whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.

- The act prescribes the obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions

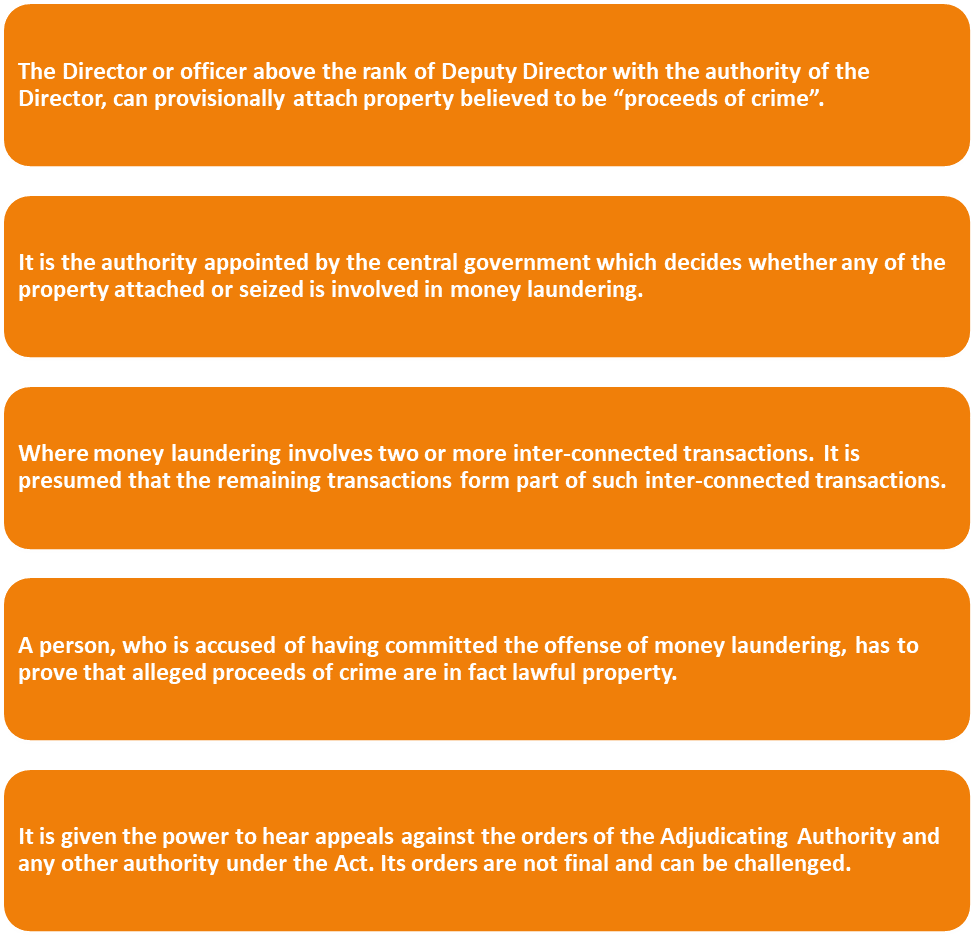

- It empowers certain officers of the Directorate of Enforcement to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

- It envisages setting up of an Adjudicating Authority to exercise jurisdiction, power and authority conferred by it essentially to confirm attachment or order confiscation of attached properties.

- It also envisages setting up of an Appellate Tribunal to hear appeals against the order of the Adjudicating Authority and the authorities like Director FIU-IND.

- It envisages designation of one or more courts of sessions as Special Court or Special Courts to try the offences punishable under the act

- It allows the Central Government to enter into an agreement with the Government of any country outside India for enforcing the provisions of the the act

- The act was amended in the year 2005, 2009 and 2012

Salient Features Of PMLA

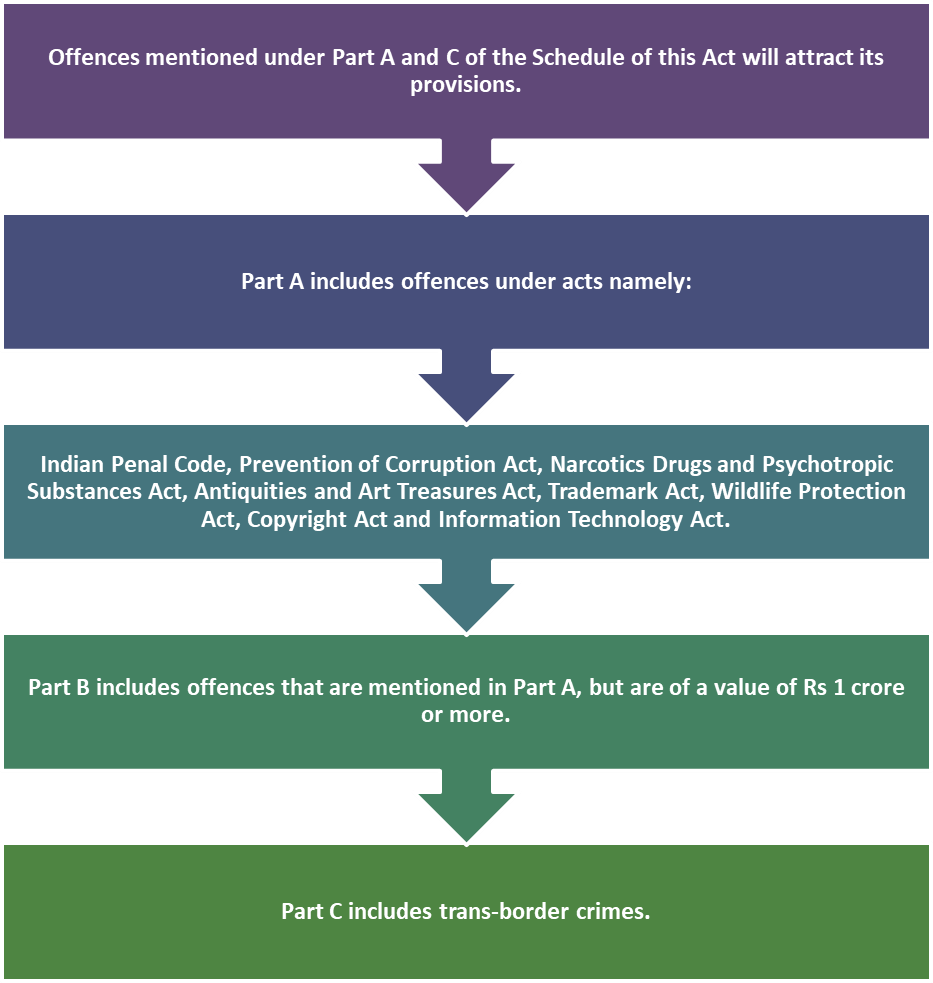

What Are The Offenses Under PLMA?

Penalties Under PMLA

- Freezing or seizing of property and records, and/or attachment of property obtained through crime proceeds.

- Money laundering is punishable with:

- Rigorous imprisonment for a minimum of 3 years and a maximum of 7 years.

- Fine.

- If the crime of money laundering is involved with the Narcotic Drugs and Psychotropic Substances Act, 1985, the punishment can go up to 10 years, along with fine.

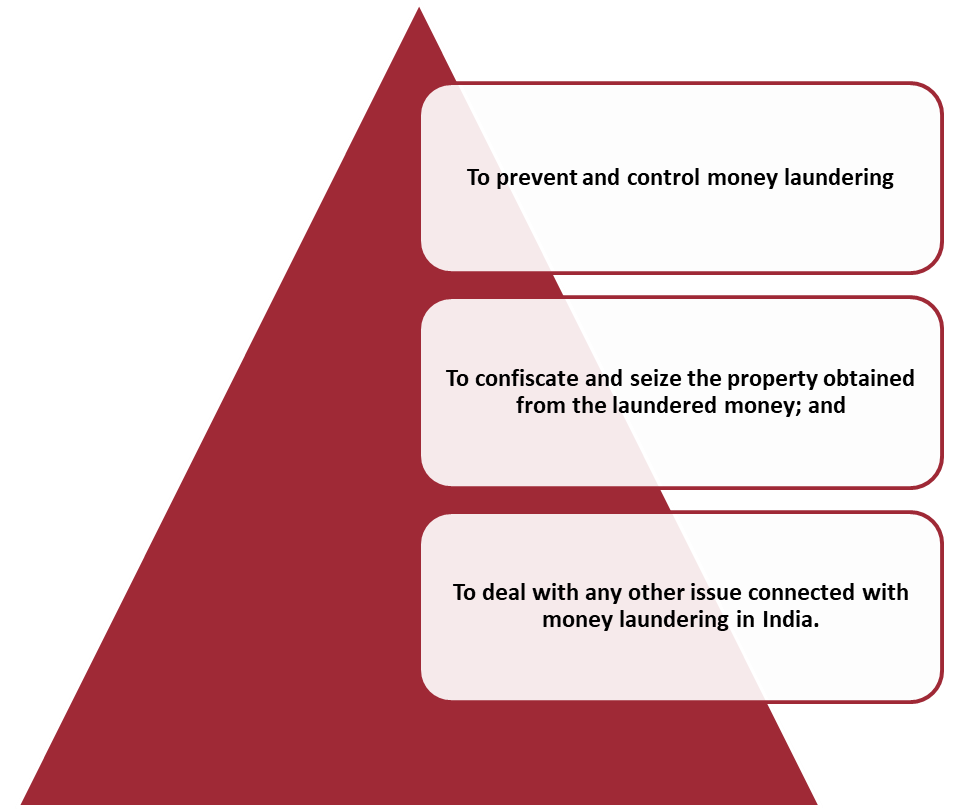

Objectives Of PMLA

The PML Act seeks to combat money laundering in India and has three main objectives:

To Download Monthly Current Affairs PDF Click here

Click here to get a free demo

Everything About CLAT 2025

Frequently Asked Questions

Prevention of Money Laundering Act (PMLA) was enacted in?

Prevention of Money Laundering Act (PMLA) was enacted in 2003

Offence of money-laundering is defined in which section of PMLA?

Offence of money-laundering is defined in Section 3 of PMLA

Adjudicating Authority appointed by Central Government shall exercise jurisdiction, powers and authority conferred by or under PMLA