RBI withdraws Rs 2000 Notes from circulation.

Key Points On RBI Withdraws Rs 2000 Notes

- The central bank has advised the public to deposit Rs 2000 banknotes into their bank accounts and /or exchange them into banknotes of other denominations at any bank branch.

- The Rs 2000 banknote will continue to maintain its legal tender status, the RBI has said. Members of the public can continue to use Rs 2000 banknotes for their transactions and also receive them in payment.

- However, they are encouraged to deposit and/ or exchange these banknotes on or before September 30, 2023

- The RBI has not clarified the status of these notes after September 30. However, it has said that its instructions on the Rs 2000 notes will be effective until that date.

Why RBI Withdraws Rs 2000 Notes?

- The Rs 2000 note was introduced in November 2016 under Section 24(1) of The RBI Act, 1934

- The were introduced primarily with the objective of meeting the currency requirement of the economy expeditiously after the legal tender status of Rs 500 and Rs 1000 notes was withdrawn.

- The printing of Rs 2000 notes was stopped in 2018-19.

- The RBI issued the majority of the Rs 2000 denomination notes prior to March 2017; these notes are now at the end of their estimated lifespan of 4-5 years.

- This denomination is no longer commonly used for transactions; besides, there is adequate stock of banknotes in other denominations to meet currency requirements.

- In view of the above, and in pursuance of the ‘Clean Note Policy’ of the Reserve Bank of India, it has been decided to withdraw the Rs 2000 denomination banknotes from circulation

RBI Withdraws Rs 2000 Notes: Clean Note Policy

- The Clean Note Policy seeks to give the public good-quality currency notes and coins with better security features, while soiled notes are withdrawn out of circulation.

- The RBI had earlier decided to withdraw from circulation all banknotes issued prior to 2005 as they have fewer security features as compared to banknotes printed after 2005.

- However, the notes issued before 2005 continue to be legal tender.

- They have only been withdrawn from circulation in conformity with the standard international practice of not having notes of multiple series in circulation at the same time.

RBI Withdraws Rs 2000 Notes: Declining Circulation

- Approximately 89% of the ₹2000 banknoteswere issued before March 2017 and have now reached their estimated life-span of 4-5 years.

- Consequently, the total value of ₹2000 banknotes in circulation has decreased from ₹6.73 lakh crore at its peak on March 31, 2018, to ₹3.62 lakh crore, constituting only 10.8% of the total notes in circulation as of March 31, 2023.

- The reduction in circulation and limited usage further prompted the decision to withdraw the ₹2000 banknotes.

Demonetisation

- On 8th November 2016, the government announced that the largest denomination of Rs 500 and Rs 1000 were demonetised with immediate effect ceasing to be a legal tender.

- It is the act of stripping a currency unit of its status as legal tender or fiat money.

- It occurs whenever there is a change of national currency and the current form or forms of money is pulled from circulation and retired, often to be replaced with new notes or coins.

Objectives Of Demonetisation

- To discourage the use of high-denomination notes for illegal transactions and thus curb the widespread use of black money.

- To encourage digitisation of commercial transactions, formalise the economy and so, boost government tax revenues.

- The formalisation of the economy means bringing companies under the regulatory regime of government and subject to laws related to manufacturing and income tax.

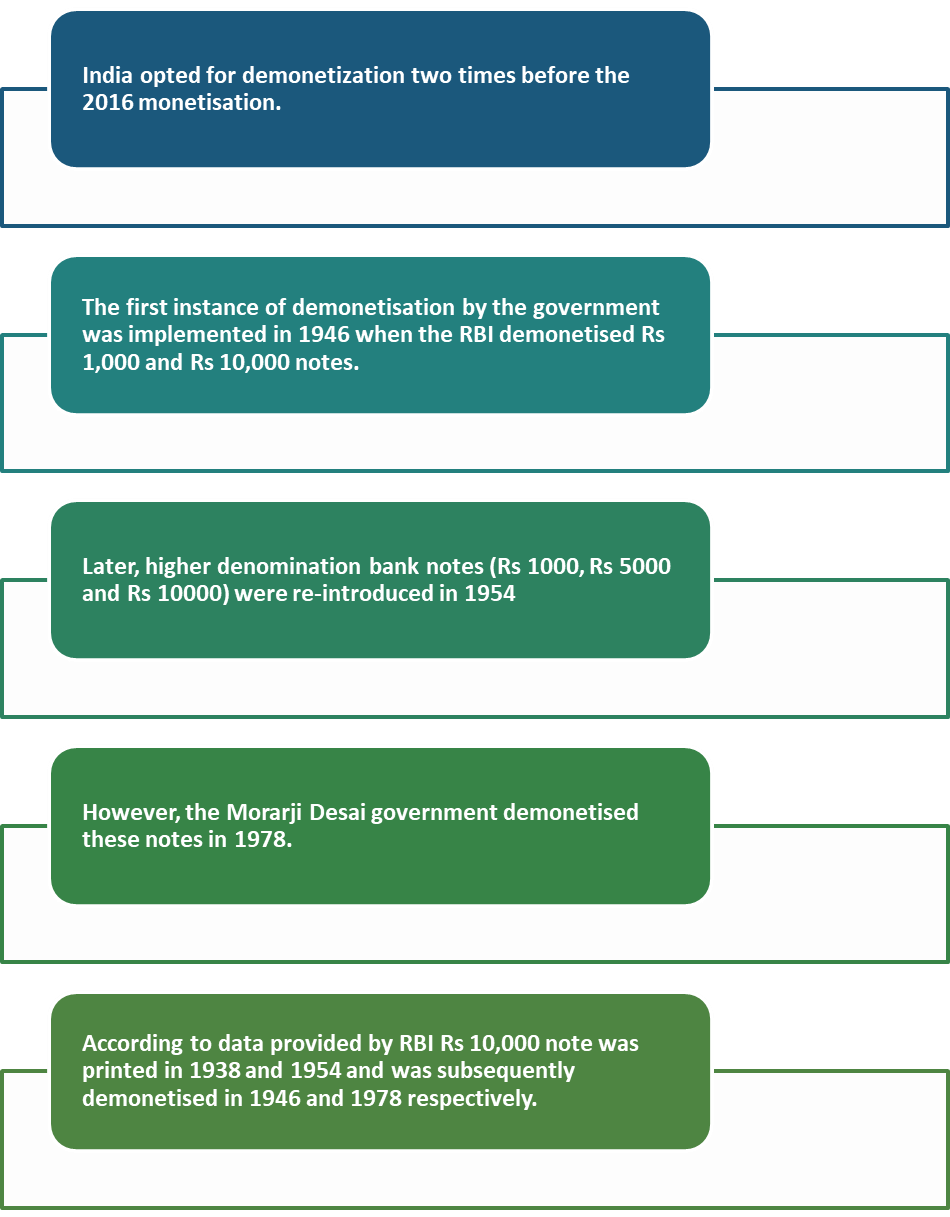

History Of Demonetisation

To Download Monthly Current Affairs PDF Click here

Get Inspiration from CLAT 2025 Topper

Click here to get a free demo

Everything About CLAT 2025